Written by Kirsty O'brien

Tags: Probate, Stages of Probate

The length of time it takes to complete the probate process – the legal right to deal with someone’s property, money and possessions (their ‘estate’) when they die – in the UK can vary significantly, depending on several factors.

They include:

- The complexity of the estate

- Whether there is a valid will

- If any disputes arise.

Unfortunately, these processes aren’t automatic, and they can take anywhere from a few days to months to complete, making an often-difficult time substantially more stressful and time-consuming. In general, the process can take any time from six months to more than a year. There are different stages to the process, with the administration of the estate likely to last the longest.

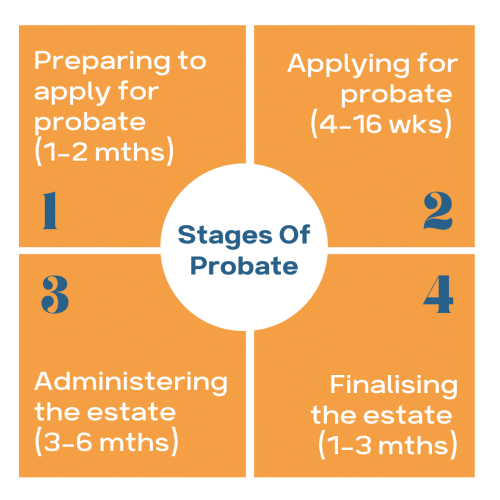

The stages of probate

Probate is a complex legal process that involves multiple stages to ensure that a deceased person’s estate is administered according to the law.

Preparing to apply for probate (1-2 months)

Applying for probate involves locating the will and gathering details of the deceased person’s assets and liabilities. The executor or administrator needs to estimate the value of the estate and work out if there is any inheritance tax due.

In the UK, the first £325,000 of an estate is tax-free. This is known as the nil rate band. If the value of the estate exceeds £325,000, the excess is taxed at 40 per cent.

But there is an additional allowance for those passing on their main residence to direct descendants, such as children or grandchildren.

Applying for probate (4-16 weeks)

The next stage is to submit the probate application to the Probate Registry and wait for the grant of probate to be issued. This should take between four weeks and three months, although the UK Government states that at present this can take up to 16 weeks because of well-publicised delays to the system.

Administering the estate (3-6 months)

To administer the estate, the executor needs to collect the estate’s assets, pay off any debts and distribute the remaining assets to the beneficiaries named in the will.

Finalising the estate (1-3 months)

In completion, the executor will finalise any outstanding matters, such as settling taxes and getting clearance from HMRC, and then will prepare and distribute the final estate accounts to the beneficiaries.

Factors that can extend the time probate takes

A number of factors can delay the probate process, such as:

- disputes among beneficiaries or claims against the estate.

- difficulties in locating beneficiaries (Finders International runs a specialised service aimed at locating missing heirs to estates)

- complex or foreign assets, and needing to add these to the estate

- delays in obtaining information or the documents needed for the application

Simple estates might be administered in around six months, but more complex situations can take a year or longer to fully resolve.

Why does probate take so long?

Probate can take a long time due to several factors, these include;

Volume of Paperwork: The probate process involves a significant amount of paperwork, including the deceased’s will, death certificate, and detailed accounts of their assets and liabilities. Gathering and verifying these documents can take time.

Asset Valuation: All of the deceased’s assets need to be accurately valued, which can be a time-consuming process. This includes property, bank accounts, investments, and personal belongings. Some assets, like property or shares, may require professional valuations.

Inheritance Tax: If inheritance tax is due, it must be calculated and paid before probate can be granted. This can involve complex calculations and, sometimes, negotiations with HM Revenue and Customs (HMRC).

Complexity of Estates: The complexity of the estate can significantly impact the duration of the probate process. Estates with numerous assets, international assets, business interests, or complicated financial arrangements can take longer to administer.

Disputes and Challenges: If there are disputes among beneficiaries or challenges to the validity of the will, the probate process can be significantly delayed. Legal proceedings to resolve these issues can take months or even years.

Executor Delays: The executor(s) of the will are responsible for administering the estate. Delays can occur if executors are slow to act, are not well-organized, or if there are multiple executors who need to coordinate their actions.

Court Backlogs: Probate applications must be reviewed and approved by the probate registry. Backlogs at probate registries can lead to delays, particularly if there are surges in applications or staffing shortages.

Administrative Errors: Mistakes in the application or missing documentation can cause delays, as corrections need to be made and additional information provided.

Distribution of Assets: After probate is granted, the executor must distribute the assets to the beneficiaries. This can involve selling property, transferring investments, and ensuring all debts and taxes are paid, which can also take time.

Legal and Professional Advice: Executors may need to seek legal or professional advice, particularly if the estate is complex. Coordinating with solicitors, accountants, and other professionals can add to the time required.

What does the probate registry do?

The probate registry is part of the HM Courts & Tribunal Service. It is responsible for issuing documentation such as Grants of Probate and Grants of Letters of Administration, which authorise individuals to manage and distribute the estate of a deceased person.

What is a grant of probate?

A grant of probate is an official document issued by a probate registry in the UK that confirms the legal authority of the executor or executors named in a deceased person’s will to administer their estate.

What is the role of an executor?

In the UK, an executor is responsible for managing and settling a deceased person’s estate according to their will. This involves applying for probate to gain legal authority, valuing the estate, paying debts and taxes, and distributing assets to beneficiaries. The executor must handle various administrative and legal tasks, maintain detailed financial records, communicate with beneficiaries, resolve disputes, and ensure compliance with legal obligations. Their role is critical in ensuring that the estate is administered efficiently and in accordance with the deceased’s wishes.

Tracking a probate application UK online

You can easily track the progress of your probate application online in the UK by heading to the Gov.uk website. Simply sign into the probate service to see completed applications as well as the progress of any existing applications.

How much does the probate process cost in the UK?

In the UK, probate typically costs between £1,000 and £5,000. However, for larger estates, costs can exceed £20,000. This variation is due to the differing fee structures among probate solicitors. Some provide a fixed-price quote upfront, while traditional providers often charge based on an hourly rate or a percentage of the estate’s value.

How can Finders International help with probate?

Finders International is a professional probate genealogy firm that specialises in tracing heirs, locating missing beneficiaries, and uncovering unclaimed assets. Our services can be valuable during the probate process, in several ways:

- Tracing Missing Heirs and Beneficiaries: If there are heirs or beneficiaries who cannot be easily located, we can help trace them, ensuring that the estate is distributed according to the will or intestacy rules.

- Unclaimed Assets: We can assist in identifying and recovering unclaimed assets that may have been overlooked, adding value to the estate.

- Document Verification: We can help verify legal documents, such as wills and birth certificates, ensuring that the probate process proceeds smoothly.

- Estate Administration Support: We provide general support for estate administration, helping executors or administrators navigate complex legal and administrative tasks.

Our specialised expertise can complement the probate process, particularly in more complex cases where heirs or assets are difficult to locate. Notice that Finders International has been ‘Best UK Probate Research Firm’ in 2024 and for an impressive sixth consecutive year.

Contact us today!