Medallion Signature Guarantees

What is a Medallion Signature Guarantee?

Medallion Signature Guarantee stamp fees start from

- * UK applicants only. Fees may vary: please contact us to discuss your requirements.

Click here for help with the full process of transferring or selling shares.

Contact Us

"*" indicates required fields

How do Medallion Signature Guarantees Work?

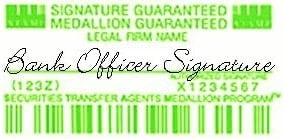

To offer a Medallion signature guarantee, an institution must be a member of one of the three Medallion signature guarantee programs: the Securities Transfer Agents Medallion Program (STAMP), the Stock Exchanges Medallion Program (SEMP), or the New York Stock Exchange Medallion Signature Program (MSP).

Typically, applicants in the USA and Canada can quite easily get a Medallion signature guarantee at their financial institution where they hold an account. However, applicants outside of North America may struggle to meet this requirement, as many non-US banks and financial institutions do not offer this service.

Obtaining a Medallion Guarantee stamp can be challenging, because the stamp is quite literally a guarantee that the person seeking to change the ownership of securities is who they say they are, and is the proper, entitled person to make that change. So confirming those points is a rigorous process.

Who can issue Medallion Signature Guarantees?

Providers of the Medallion Guarantee Stamp in the UK are all members of the Securities Transfer Agents Medallion Program (STAMP). They comprise a handful of companies in the UK who are authorised to issue the Medallion Guarantee Stamp, but only when they are entirely satisfied that all criteria have been meticulously observed.

As agent for a STAMP member, Finders International provides a no-nonsense service. We will review your documentation before submitting an application, helping prevent delays. The stamped document is returned to you, to allow you to continue working with the North American financial institution requiring the Stamp.

Why do I need a Medallion Signature Guarantee?

For someone who is living outside the US and holding stock in a US or Canadian listed company, the only way to sell the shares or transfer the ownership into a different name is to submit a Medallion Guarantee stamped Transfer Request or Stock Power Form to the transfer agent along with various required documents.

Medallion signature guarantees can be used for many purposes, but the most common reasons are when:

- Securities are gifted

- Securities are moved from one account to another

- The owner of the security passes away

Medallion Signature Guarantee and Share Certificates

Medallion Signature Guarantee stamps are often associated with share certificates, which are written documents that serve as legal proof of ownership of a specific number of a company’s shares. Shares held in ‘bookentry’ or electronic form may not have share certificates. Information about how these shares are owned can instead be found in dividend or account statements sent out from time to time by the company’s share registrar (transfer agent).

Key details found on a share certificate typically include:

- Certificate number

- Company name and registration number

- Shareholder’s name and address

- Number of shares owned

- Class of shares

- Issue date of shares

Shares can be issued in different classes. Each class of shares provides distinct rights regarding dividends and voting options. If a share certificate is lost or stolen, the company can issue a replacement, but will require a surety bond or indemnity and an Affidavit attesting to the circumstances of the loss.

Case Study

When Mrs Joyce died, her estate included a portfolio of shares listed in the UK and USA. After checking all the paperwork and finding numerous dividend cheques and counterparts, and piecing together the information, her Executors found that the US shares she held, had included Keurig Dr Pepper Inc, Kraft Heinz Company and Mondelez International.

The Executors realised that, having once held Cadburys shares, she had unwittingly become an overseas shareholder of US listed stock. All three of the holdings are listed in the USA; and both Keurig Dr Pepper Inc and Kraft Heinz Company have US-based transfer agents (or share registrars). In her later years, and in declining health, Mrs Joyce took no action to sell the shares when opportunities arose, and did not realise the significance, for her estate, of having US-listed shares in her portfolio.

Those consequences came to light when Mrs Joyce’s family instructed her solicitor to sell the shares. They had no idea of the headache that was to follow…

The solicitor wrote to the transfer agents with a copy of the death certificate, to let them know that Mrs Joyce had died and that the Executor wished to sell the shares. They received an automated, generic letter listing the documents that would need to be submitted in order to transfer the shares into a different name. It was not clearly explained that shares cannot be sold directly from a deceased shareholder’s account; there must first be a transfer to a new name or names. The requirements included a “Court Order…or Letters Testamentary”, an IRS tax form (W-8BEN), an “Affidavit in Lieu of a Federal Transfer Certificate” and a Medallion Guarantee Stamped transfer request (or stock power) form. Each transfer agent or registrar had different requirements. Even the language was different; ‘decedent’, ‘Letters Testamentary’, ‘nonresiden alien’ and so on.

Neither the solicitor nor the widow had heard of a Medallion Guarantee Stamp, and the list of documents was confusing. Suddenly this was looking like a complicated and time-consuming procedure to complete. After a frustrating round of calls to the USA, the solicitor conferred with a colleague who put her onto Louise Levene at Finders International, whose International Asset Services team brings a wealth of experience to dealing with overseas assets of all kinds. For a one-off fee, Louise and her team were able to prepare the necessary documents ready for signature, obtain the Medallion Guarantee stamp, liaise with the US authorities, and in a matter of months the US shares had been transferred out of Mrs Joyce’s sole name, and sold, with the proceeds going directly to the solicitor’s client account. Mrs Joyce’s family received around $39,000 USD from the sale. They opted not to re-invest the money in US stocks…

Finders can assist with the sale or transfer of shares in the USA and beyond: please contact us to request a quote.

When Sarah divorced, she thought it would be simple to transfer her late father’s shares, a wedding gift to her many years previously, back into her maiden name. She wrote to the transfer agent (share registrar) with the relevant documents, but the response, several weeks later, was an automated letter telling her that she needed to obtain a Medallion Guarantee Stamp on the transfer document, before the name on the share certificate could be transferred into her sole name.

A Medallion Guarantee Stamp is a special guarantee for the transfer of securities for all US and Canadian shares, which affirms that the person transferring the shares is able to do so. US regulations stipulate that without this stamp the shares cannot change name or ownership.

Sarah researched all the information she could find about obtaining a Medallion Guarantee Stamp, including how much they cost and who offered to obtain them for shareholders living outside of North America. She settled upon Finders International because they were the most friendly and efficient when she contacted them. It was also helpful that they were able to take payment in Euros, as they have an office in Dublin. Sarah sent in the required documents, which included various forms of identification and the transfer request form supplied by the transfer agent, and within a matter of days the Medallion Guarantee stamped document was on its way back to her.

She was then able to re-apply to have the shares changed into her sole name.

Finders can also help you with the full process of transferring or selling US stock. For more information please contact us.